Proactive Defense: Bagley Risk Management Tips

How Animals Threat Protection (LRP) Insurance Can Secure Your Animals Financial Investment

Animals Risk Protection (LRP) insurance coverage stands as a dependable guard versus the uncertain nature of the market, supplying a strategic method to securing your possessions. By diving right into the details of LRP insurance policy and its complex benefits, livestock producers can fortify their investments with a layer of safety and security that transcends market fluctuations.

Recognizing Animals Threat Defense (LRP) Insurance Policy

Recognizing Livestock Risk Defense (LRP) Insurance coverage is important for animals manufacturers wanting to mitigate economic dangers related to rate changes. LRP is a federally subsidized insurance policy product made to secure producers versus a drop in market value. By offering insurance coverage for market cost decreases, LRP assists manufacturers secure a flooring price for their animals, making sure a minimum degree of profits despite market variations.

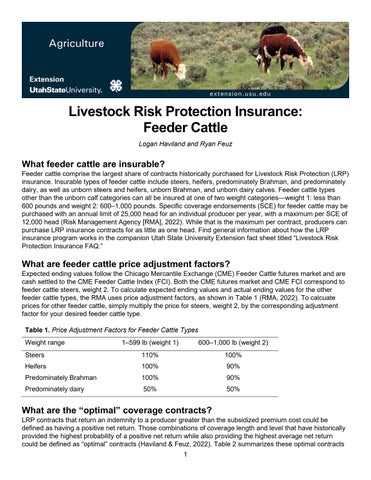

One key facet of LRP is its versatility, allowing manufacturers to personalize coverage degrees and policy sizes to match their particular demands. Producers can choose the variety of head, weight array, insurance coverage cost, and protection duration that line up with their production objectives and run the risk of resistance. Comprehending these adjustable alternatives is crucial for manufacturers to effectively handle their price danger direct exposure.

Furthermore, LRP is offered for different livestock types, consisting of cattle, swine, and lamb, making it a flexible threat management tool for livestock producers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, manufacturers can make enlightened choices to safeguard their investments and make sure economic security despite market unpredictabilities

Advantages of LRP Insurance for Animals Producers

Livestock producers leveraging Animals Danger Security (LRP) Insurance gain a critical benefit in protecting their investments from rate volatility and safeguarding a steady financial ground in the middle of market uncertainties. By establishing a flooring on the cost of their livestock, manufacturers can alleviate the risk of substantial monetary losses in the event of market declines.

Furthermore, LRP Insurance offers producers with tranquility of mind. Knowing that their investments are safeguarded versus unanticipated market modifications allows producers to concentrate on other facets of their company, such as enhancing animal health and wellness and well-being or enhancing manufacturing processes. This tranquility of mind can bring about boosted efficiency and success over time, as producers can operate with more confidence and stability. Generally, the advantages of LRP Insurance coverage for livestock manufacturers are substantial, providing a beneficial device for managing risk and making sure economic security in an unpredictable market environment.

Exactly How LRP Insurance Coverage Mitigates Market Dangers

Minimizing market threats, Animals Danger Security (LRP) Insurance offers livestock producers with a reputable shield against cost volatility and financial uncertainties. By providing security against unexpected price drops, LRP Insurance aids producers secure their investments and maintain monetary stability in the face of market variations. This sort of insurance policy permits livestock manufacturers to lock in a rate for their animals at the start of the policy period, ensuring a minimum rate level despite market modifications.

Actions to Safeguard Your Livestock Investment With LRP

In the world of farming threat management, executing Livestock Danger Security (LRP) Insurance coverage includes a strategic process to protect financial investments versus market variations and unpredictabilities. To secure your livestock investment successfully with LRP, the initial step is to evaluate the certain dangers your operation faces, such as price volatility or unanticipated climate occasions. Recognizing these threats permits you to figure out the insurance coverage level needed to safeguard your investment effectively. Next, it is essential to research and select a respectable insurance coverage service provider that provides LRP policies customized to your animals and business demands. Meticulously examine the more information policy terms, problems, and coverage restrictions to ensure they straighten with your risk monitoring goals as soon as you have selected a supplier. Furthermore, routinely monitoring market fads and adjusting your protection as required can assist maximize your protection versus potential losses. By complying with these actions faithfully, you can enhance the safety of your animals investment and browse market unpredictabilities with confidence.

Long-Term Financial Safety With LRP Insurance Policy

Ensuring enduring monetary security through the use of Animals Threat Defense (LRP) Insurance is a prudent long-lasting method for farming manufacturers. By incorporating LRP Insurance policy into their danger administration strategies, farmers can guard their animals financial investments versus unexpected market variations and damaging occasions that might threaten their economic well-being over time.

One trick benefit of LRP Insurance policy for long-lasting financial security is the assurance it uses. With a trusted insurance plan in position, farmers can minimize the financial threats connected with unpredictable market conditions and unexpected losses due to variables such as condition episodes or all-natural calamities - Bagley Risk Management. This stability enables producers to focus on the day-to-day operations of their animals business without continuous fret about potential monetary problems

Moreover, LRP Insurance policy offers an organized technique to managing danger over the long-term. By setting details protection degrees and selecting ideal endorsement durations, farmers can customize their insurance coverage intends to align with their economic goals and run the risk of resistance, making sure a safe and lasting future for their livestock procedures. In verdict, investing in LRP Insurance coverage is an aggressive strategy for agricultural manufacturers to achieve long lasting monetary security and safeguard their source of incomes.

Conclusion

To conclude, Animals Threat Defense (LRP) Insurance is an important device for livestock producers to minimize market threats and secure their investments. By comprehending the advantages of LRP insurance and taking steps to execute it, manufacturers can attain lasting economic security for their operations. LRP insurance offers a security internet versus price changes and makes certain a degree of security in an unforeseeable market setting. It is a smart choice for securing livestock investments.